Fast-Tracking Profits: Strategies and Insights for Effective Futures Trading

Every trader wants to make profits, yet not all investors learn how to take full advantage of profits. A single typical oversight that a great many dealers make is entering trades without having a clear exit approach. This may lead to missed possibilities and potentially even loss. That’s where take profit methods enter into play. By mastering take profit tactics, investors can position themselves to optimize earnings and minimize dangers. In this article, we’ll review some of the most successful take profit tactics that dealers may use to become more productive.

Use Trailing Stops

Trailing ceases are a good way to lock in earnings whilst decreasing hazards. A trailing quit is a kind of order which is put at the particular percent or dollar sum away from the selling price. As being the market price techniques in favor of the industry, the trailing stop will transfer appropriately, properly “trailing” the industry price. Which means that in case the market price suddenly reverses from the industry, the quit damage will likely be caused in the trailing quit degree, and helps to restriction deficits. Establishing a trailing quit will also help forex traders capture larger sized profits as the market price consistently move in their favour.

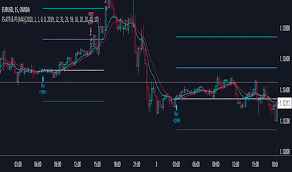

Determine Price Concentrates on

Cost concentrates on are predetermined ranges where forex traders intend to take revenue. Setting up a value focus on will help dealers prevent the emotionally charged rollercoaster of greed and concern. By figuring out beforehand the best places to take earnings, traders are able to keep their inner thoughts in balance and adhere to their trading strategy. Value goals could be depending on practical examination, including support and resistance amounts, or basic evaluation, like earnings reports or other market place information.

Level Out from Investments

Scaling out of deals implies getting part profits as being the buy and sell moves in favor. For example, if your trader opens a position with 100 reveals, they might want to futures trading discount in increments of 25 gives because the business goes with their favor. This is often an efficient way to freeze income whilst letting the rest of the gives to keep to perform in the hopes of taking larger benefits. Scaling from trades can also help investors control risk because they take profits along the way.

Use Several Targets

Employing multiple goals is an effective way to take earnings while also enabling some shares to perform. For example, a trader may determine three cost focuses on for the business: one at the conservative degree, 1 at the reasonable degree, and one with an aggressive level. By using earnings at diverse ranges, investors can lock in some revenue while still allowing some offers to operate in the hopes of recording even greater results.

Stay away from Greed

Lastly, just about the most essential take profit tactics is to avoid greed. It’s very easy to become greedy each time a business is certainly going in your prefer, and traders might be influenced to carry on even for greater benefits. Nonetheless, this may lead to missed options when the market place suddenly reverses versus the business. By setting a practical take profit target and sticking to it, traders can avoid getting distracted by mental swings and alternatively give attention to refining returns.

In short:

Understanding take profit tactics is crucial for any trader who would like to optimize earnings and minimize dangers. Through the use of strategies such as trailing stops, developing price goals, scaling out of trades, using a number of focuses on, and preventing greed, traders can situation themselves for achievement. Keep in mind, the trick is to remain self-disciplined and stick to your trading program. Delighted trading!